Loading...

A guide to the FMO Independent Complaints Mechanism (ICM)

If the FMO Dutch Entrepreneurial Bank has funded or supported the project that is causing you harm, you may be able to file a complaint with their accountability mechanism, the Independent Complaints Mechanism (ICM).

What is the FMO Dutch Entrepreneurial Bank?

The FMO Dutch Entrepreneurial Bank (FMO) is a Dutch development finance institution. It was founded in 1970 and is a public-private partnership, with 51% of its shares held by the Dutch State and 49% held by commercial banks, trade unions and other members of the private sector. It provides financing and expertise to private sector projects in 85 developing countries, with a focus on sustainable, inclusive growth. FMO prioritizes investments in renewable energy, agribusiness, financial institutions, and green innovation, aiming to reduce inequality and support climate action.

What is the ICM?

FMO, together with Proparco and Deutsche Investitions- und Entwicklungsgesellschaft (DEG), which also have pages in this Guide, share an Independent Complaints Mechanism (ICM). The ICM consists of the Independent Expert Panel (IEP) and the respective Complaints Office of Proparco, DEG, and FMO. FMO’s Complaints Office function is performed by FMO’s Internal Audit department.

The ICM receives complaints related to harm caused or threatened by projects financed by any of these three banks. If you are, or may be, affected by a FMO-funded project, you can file a complaint with the ICM.

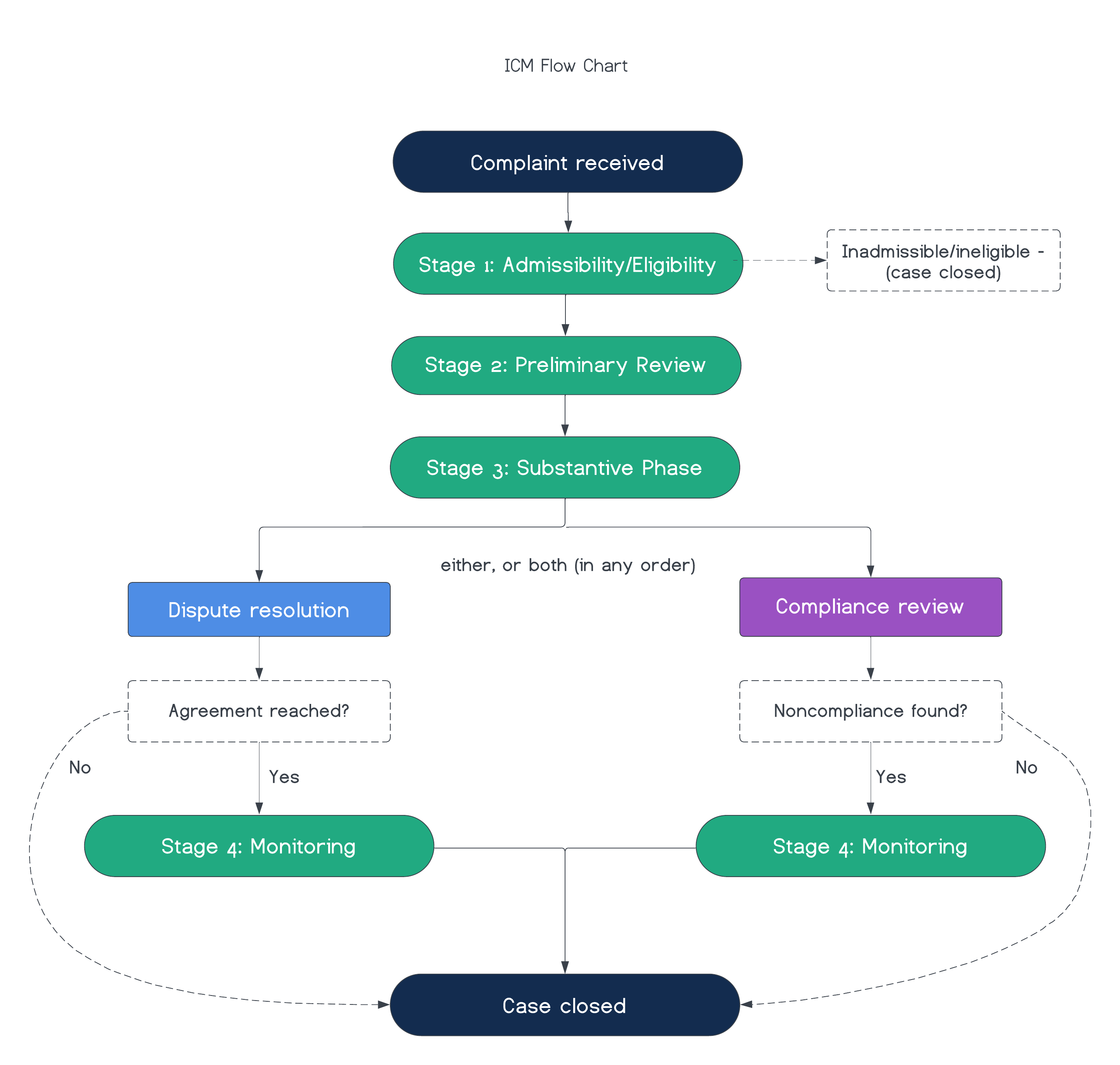

If your complaint is found to be eligible, the ICM has two functions to try to resolve the complaint: dispute resolution (also known as problem solving) and compliance review. You can decide which process you would like your complaint to enter if found eligible. If you want to try both dispute resolution and compliance review, the ICM offers the flexibility to conduct either process one-after-the-other. The two functions cannot be done simultaneously. You can learn more about the difference between dispute resolution and compliance review, and which option is better for your complaint on the homepage of this Guide.

Note, that the ICM Policy for the three banks are currently under revision, with an updated policy expected to be published in 2026. We are closely following this process and will update this guide as soon as possible after the publication of the new policy. You can find more information about the review process here: https://icm-consultation.org/review_and_update/.

Dispute Resolution

The ICM’s voluntary dispute resolution process (also referred to as problem solving) aims to resolve issues collaboratively. During the dispute resolution phase, the ICM will appoint a neutral facilitator who will facilitate information sharing, fact-finding, dialogue, and/or mediation, between the affected communities and FMO’s client, with the goal of reaching mutually agreeable solutions to the issues raised in the complaint.

Dispute resolution is a voluntary, flexible process and depends on the willingness of all parties to participate. If an agreement is reached, the facilitator will help the parties to formalize it. If the process fails, the complaint may proceed to compliance review (if it hasn’t already been undertaken).

You can learn more about this phase below.

Compliance Review

At the ICM, the fact-finding investigation process is called “compliance review”. During the compliance review, the ICM investigates whether FMO has complied with its policies, and whether any non-compliance has contributed to harm to the community. The ICM then prepares a compliance report with findings and recommendations. Recommendations may include steps needed to correct the issues with the project, or avoid similar issues in the future.

If significant issues are found, ICM will monitor FMO’s response to the compliance report until it is satisfied that the issues are being addressed.

You can learn more about this phase below.

Can you complain to ICM?

Before filing a complaint, ask yourself the following questions. If your answer is YES to all of the questions, then you can complain to the ICM.

The ICM accepts complaints about projects that are actively being funded, or “will” be funded, by FMO.

Tip: You can find information about projects in the FMO Project Database, by emailing disclosure@fmo.nl, or through the DeBIT tool (a database you can search).

The ICM accepts complaints from:

- One or more people, groups, or organizations who are experiencing (or are likely to experience) harm as a result of a FMO-financed project.

- Authorized representatives can file a complaint on behalf of affected individuals or communities.

Important: Complaints cannot be submitted anonymously, but you can request confidentiality regarding your identity or sensitive information. If you fear retaliation, notify the ICM immediately to discuss protective measures.

The complaint could be about human rights abuses, or other environmental and social impacts or risks, which negatively affect you and which are linked to the project financed by FMO. If possible, you should explain how FMO has contributed to this harm (for example, by failing to comply with its policies).

The ICM may require that complainants attempt to resolve concerns with FMO, its client, or other authorities before submitting a complaint to the ICM. If you are not able to meet this requirement, for example due to fears of retaliation, bad experiences with project stakeholders, or severe communication barriers, you should explain this in your complaint. At the time of publication of this guide, we are not aware of any complaints being rejected for not meeting this requirement.

Sample complaint letter

Complaint filing checklist

Download checklistStrengthen your complaint by referencing FMO policies

When filing your complaint to the ICM, you may want to reference FMO policies that were violated. Environmental and social safeguard policies, in particular, play an important role in your complaint. These safeguards are rules and policies designed to identify and mitigate risks associated with FMO activities, with an overarching goal of preventing environmental and social harms. Understanding these safeguards is essential for anyone seeking to hold banks accountable for harms associated with their investments.

The ICM reviews concerns that FMO has failed to comply with a range of its policies, as listed here: https://www.fmo.nl/policies-and-position-statements. These policies include FMO’s Sustainability Policy, its Exclusion List, as well as position statements on a range of environmental and social issues.

FMO also conforms to the European Development Finance Institutions’ “Principles for Responsible Financing of Sustainable Development” and its Harmonised ESG Standards, which require compliance with the IFC Performance Standards and the World Bank Group Environmental, Health, and Safety General Guidelines. We have summarised these standards below.

NOTICE: Including references to these policies is optional but can strengthen your complaint by identifying clear grounds for FMO’s accountability.

FMO Policies

FMO’s Sustainability Policy requires that all FMO projects comply with the following obligations (among others) -

- Screen and assess risks: Clients must assess project risks and, for higher-risk projects, prepare Environmental & Social Action Plans or other corrective action plans. FMO screens all investments against its Exclusion List (which defines the type of activities in which FMO does not invest) and carries out its own environmental and social due diligence. During that due diligence, FMO will assess the quality of the client’s risk management and mitigation measures. This assessment could lead to changes to the project, the intensity of monitoring, or a decision not to invest.

- Align with climate goals: FMO also assesses projects’ alignment with the goals of the Paris Agreement.

- Human rights: FMO commits to respect internationally recognized human rights standards and to take measures to avoid supporting activities that may cause or contribute to human rights violations. FMO requires its clients to assess the likelihood and severity of impact on human rights as part of their assessment of social and environmental impact, and to implement appropriate mitigation measures.

- Additional standards: FMO requires medium and higher risk projects to comply with the following additional standards:

- IFC Performance Standards,

- World Bank Group Environmental Health and Safety Guidelines,

- OECD Guidelines for Multinational Enterprises,

- UN Guiding Principles on Business and Human Rights,

- ILO Declaration on Fundamental Principles and Rights at Work, and

- EDFI Principles for Responsible Financing of Sustainable Development.

Taken together, these standards require that FMO projects:

-

- Apply the mitigation hierarchy to avoid, minimize, mitigate, compensate environmental and social impacts,

- Integrate protections for community health and safety, the climate, biodiversity, pollution prevention, and resource efficiency into its project assessments and financing decisions,

- Pay special attention to Indigenous peoples, women, and marginalized communities, ensuring their rights, cultures, and livelihoods are respected,

- Avoid involuntary resettlement where possible. If unavoidable, FMO projects must provide fair compensation, livelihood restoration, and respect for international best practice, and

- Prohibit child and forced labor, and provide safe and fair working conditions, and respect freedom of association.

- Anti-retaliation: FMO does not condone violations of human rights by its clients, including oppression of, or violence towards, those who voice their dissenting opinion in relation to FMO’s activities and the activities of FMO’s clients.

- Stakeholder engagement and grievance channels: Clients are expected to consult affected communities, provide accessible grievance mechanisms, share project information, and prevent retaliation against complainants.

- Monitoring and reporting: FMO monitors environmental and social performance throughout the investment. Clients must provide regular reports, host site visits, and cooperate with external audits where needed.

Under its Exclusion List, FMO is not permitted to finance certain activities, including -

- Any activity that is illegal under the laws of the host country or international conventions or agreements;

- Any project involving forced labour or child labour;

- Destruction of high value conservation areas;

- Among others.

In addition to these policies, the FMO also has a series of position statements on the following topics, including -

- Position Statement on Coal and on Phasing Out Fossil Fuels from Our Investments

- Position Statement Impact and ESG and Financial Intermediaries

- Position Statement on Human Rights

- Position Statement on Gender

- Position Statement Land Governance

- Position Statement on Hydro Power Plants

- Position Statement on Responsible Tax

- Position Statement on Animal Welfare

The Association of European Development Finance Institutions policies

As a member of the Association of EDFIs, FMO has committed to:

- Follow the law: Make sure their clients, including banks and other financial institutions, comply with local legal and regulatory requirements wherever they operate.

- Prevent harm: Require clients to reduce risks of negative impacts on people, communities, and the environment. This includes following international standards such as the IFC Performance Standards, the World Bank’s Environmental, Health and Safety Guidelines, International Labour Organization rules, and internationally-recognized human rights standards. Clients are also encouraged to extend these standards to their supply chains, including contractors.

- Consultation: Encourage clients to have open discussions with local people and other stakeholders about the environmental and social impacts of their activities.

- Maximize positive impacts: Commit to ongoing improvements in how environmental, social, and human rights issues are managed, to maximize positive impacts for people, workers, and communities.

- Act on climate: Support the Paris Climate Agreement by directing finance toward low-emissions, climate-resilient development.

- Be transparent: Provide clear and accountable information about investment activities, while respecting commercial confidentiality and client privacy.

World Bank Group Policies

The World Bank requires its clients to comply with ten performance standards, relating to: Assessment and Management of Environmental and Social Risks and Impacts; Labor and Working Conditions; Resource Efficiency and Pollution Prevention and Management; Community Health and Safety; Land Acquisition, Restrictions on Land Use and Involuntary Resettlement; Biodiversity Conservation and Sustainable Management of Living Natural Resources; Indigenous Peoples/ Sub-Saharan African Historically Underserved Traditional Local Communities; Cultural Heritage; Financial Intermediaries; and Stakeholder Engagement and Information Disclosure. You can find more information on the World Bank page of this Guide.

The EHSG require projects to follow international good practice to prevent harm to people and the environment. This means controlling pollution (air emissions, wastewater, noise, waste, and hazardous materials), protecting workers through safe conditions and training, safeguarding nearby communities from health and safety risks, and managing impacts during construction and closure. Projects must also monitor and report their performance, engage with affected stakeholders, and restore sites responsibly. You can find more information on the World Bank page of this Guide.

The IFC requires its projects to meet the a series of eight performance standards relating to: Assessment and Management of Environmental and Social Risks and Impacts; Labor and Working Conditions; Resource Efficiency and Pollution Prevention; Community Health and Safety; Land Acquisition and Involuntary Resettlement; Biodiversity Conservation and Sustainable Management of Living Natural Resources; Indigenous Peoples; and Cultural Heritage. You can find more information on the IFC/MIGA page of this Guide.

Within five working days of receiving your complaint, the ICM will acknowledge receipt of the complaint and forward it to the Independent Expert Panel (IEP). The IEP is a key component of the ICM: it is made up of three panel members who are independent of (and do not work for) FMO, with expertise in areas like human rights, the environment, or development. If the complaint is filed in a language other than English, additional time may be needed for translation.

Within a further 25 working days, the IEP will determine whether the complaint is "admissible" for the ICM process. Although the ICM refers to this stage as admissibility, it is similar to the "eligibility" phase at other complaint offices. The IEP will assess:

- Project: The complaint must be related to a project actively funded (or “will” be funded) by FMO.

- Harm: The complaint must raise concerns about substantial harm (particularly environmental and/or social risks and impacts) that was or may be caused by the FMO project.

- Impact on the complainant(s): The complainant(s) is/are currently or likely to be affected by the harm described in the complaint.

- A connection between the harm and FMO's actions or omissions: There must be some connection between the harm and FMO failing to comply with its policies.

- Prior efforts: The ICM may require that complainants attempt to resolve concerns with FMO, its client, or other authorities before submitting a complaint to the ICM, however we are not aware of any complaint being rejected for not doing this. The IEP may make exceptions if you fear retaliation or face other barriers to meeting this requirement.

Your complaint will not be found admissible/eligible if it is filed mainly to get a business advantage, or if it is repetitive of prior complainants, frivolous, or malicious.

If the issues raised by the complaint are the same as another complaint that is already being dealt with by another complaint office or a court, the IEP will decide on a case-by-case basis whether the complaint can be handled in a way that does duplicate work already done or hinder ongoing procedures. If the project you are complaining about is financed by multiple banks with complaint offices, it is possible to file a complaint with more than one of those banks, and the ICM will generally seek to cooperate/collaborate with them to avoid duplication or disruption.

The IEP makes the final decision on admissibility/eligibility. If your complaint is deemed admissible/eligible (or partially so), IEP will proceed to the “Preliminary Review” stage.

If your complaint is found inadmissible/ineligible, the ICM will close the complaint file and inform you in writing about this decision. The ICM does not publish ineligible complaints on the FMO website.

Once a complaint has been found eligible, the IEP will launch a “Preliminary Review” into the issue(s) raised by the complainant(s). The purpose of this preliminary review is to better understand the community’s concerns and the position of FMO and its client, and to identify any information relevant to how the complaint should be managed. This includes asking the parties whether they are interested in participating in a dispute resolution process.

The IEP will review important documents and meet with relevant people — including the complainants, the company, FMO staff, government officials, and civil society groups — to collect the information it needs.

The Panel will aim to finish the preliminary review within a reasonable timeframe, however the number of days to finish the preliminary review will depend on the complexity of the case and will be communicated to all parties involved.

This stage will end with a preliminary review report, which will summarize the information gathered and note whether parties have agreed to a dispute resolution or whether the complaint will be entering compliance review.

All complaints that have been assessed and not closed should then enter a substantive phase. As mentioned, the ICM offers the flexibility of conducting compliance review and dispute resolution, in any order.

Dispute Resolution

Dispute resolution is a voluntary process where the ICM helps facilitate a “problem-solving” process between you (the complainant), the client (the organization implementing the project), and other stakeholders as appropriate.

This process can involve dialogue and negotiation, mediation, information sharing, or joint fact-finding. The ICM may act as the facilitator, or appoint an external mediator, as long as all parties agree on the selected mediator.

This process can and should be designed and implemented together. The aim of a dispute resolution is to reach an agreement between all the parties, and find a mutually agreeable solution to your concerns.

The dispute resolution process can continue as long as needed and all participants in the mediation process are committed to moving the process forward.

Voluntary: Since dispute resolution is voluntary, any party can choose not to participate and participation requires consent from all involved. If parties agree to participate, communities can share their concerns about the project directly with FMO’s client and advocate for specific solutions to their concerns.

Outcome: If the parties reach an agreement, the IEP will help them to formalize those solutions in a signed agreement and will monitor its implementation. If no agreement is reached, or if an agreement is not implemented, the case will be transferred to compliance review. Upon completion of this phase, the IEP will prepare a report on the results of the dispute resolution, which will be published on the FMO’s website.

For more details on the dispute resolution process, refer to the FMO ICM Policy.

Compliance Review

If your complaint is found eligible for compliance review, the IEP will conduct an investigation (known as a compliance review) to determine whether FMO failed to follow its environmental and social rules when financing the project.

To do this, the IEP may:

- Speak with affected people, the company, government officials, FMO staff, and civil society groups,

- Visit the project site,

- Ask for written or oral submissions, and

- Bring in independent experts to look at specific issues.

The IEP then prepares a draft report with findings on whether FMO complied with its policies. If the draft report finds that FMO has failed to comply with its policies, it will also include recommendations for how FMO can bring the project into compliance, and how to avoid similar issues in the future.

The IEP will share a copy of this draft report with the FMO first, and subsequently complainants and FMO’s client, for feedback.

After considering their comments, the IEP issues a final Compliance Review Report. The final report is sent to the Management Board and Supervisory Board of FMO.

The FMO Management Board will provide a Management Response to the final report within five days.

The ICM will then send the final Compliance Review Report, with the Management Board’s response, to the complainant(s), and publish them on FMO’s website.

For more details on the compliance review process, refer to the FMO ICM Policy.

If your complaint goes through a dispute resolution process and results in an agreement, or goes through a compliance review and material non-compliance is found, then the complaint will enter a monitoring phase.

Dispute Resolution

The ICM’s monitoring role in dispute resolution is determined on a case-by-case basis. Any agreements reached by the parties involved in the dispute resolution will usually contain a mutually agreed set of action with timelines for implementation as well as roles and responsibilities to monitor the progress made. Depending on the monitoring agreements made, the ICM will publicly disclose the outcomes on the FMO website.

Compliance Review

If the ICM’s investigation found “material non-compliance” with FMO’s policies, the ICM will monitor the situation until actions taken by FMO assure the ICM that FMO is addressing their concerns. The ICM publishes monitoring reports on the FMO website.

Comparison to best practice

Independence: The IEP is largely independent from bank management; it principally reports to FMO’s Supervisory Board.

Independence: The FMO Complaint Office, in contrast, is not independent of bank management.

Transparency: Although the ICM provides some transparency, there are some important gaps. The ICM does not publish details of ineligible complaints, other than select data in its Annual Reports. For eligible complaints, the complaint itself is not shared, only eligibility reports, final compliance reports, dispute resolution reports, and monitoring reports.

Remedy: While the ICM can make recommendations for actions that should be taken to address areas of non-compliance, it does not explicitly have a mandate to recommend remedial measures to address harm to communities.

A look at the data

We have brought together some charts, based on the latest data available in the Complaint Dashboard, to offer a deep dive into the FMO’s and the ICM’s performance.

Complaint Outcomes

Eligibility

Dispute Resolution Outcomes (when undertaken)

Compliance Review Findings (when undertaken)

Complaint issues

Complaint sectors

Policy recommendations to improve the ICM

The ICM should report directly (and solely) to FMO’s Supervisory Board, manage its own budget as approved by the Supervisory Board,, and have a full-time Chair and dedicated mechanism staff, independent of bank management. (GPP 5, 6, and 8)

The ICM should allow complaints for a period of at least two years after the end of FMO’s financial relationship with the project or two years after the complainant first became aware of the harm, whichever is later. (GPP 31)

The ICM’s policy should include an express mandate to monitor the remediation of all instances of non-compliances found. (GPP 57)

The ICM should be required to publish and share with the Supervisory Board all monitoring reports and inform them of any instances of failure to address harm. (GPP 59)

The ICM should have the authority to recommend the suspension of a project in the event of imminent harm. (GPP 43)

The ICM policy should require a regularly updated case registry which include pending, ineligible, completed and closed cases, with links to all relevant documentations (e.g. complaint form, eligibility decisions, dispute resolution reports and agreements, compliance review reports, monitoring reports) available permanently in full, not merely in summarised form. (GPP 21)

Email:

complaintsoffice@fmo.nlHead of Complaints Office

Nederlandse Financierings-Maatschappij voor Ontwikkelingslanden N.V.

P.O. Box 93060

2509 AB The Hague

The Netherlands

Date Last Updated: Feb. 8, 2026